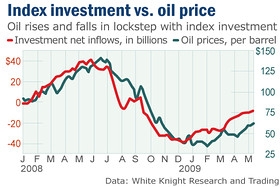

A recent article shows the chart to the left which demonstrates the correlation between crude oil prices and the size of the passive long-only institutional investor. A recent article shows the chart to the left which demonstrates the correlation between crude oil prices and the size of the passive long-only institutional investor.

This is a topic that I’ve been harping on ever since last year, as a barrel went for $135: What is really going on with the price of crude oil?

It also confirms the previous chart showing the stampede of hedge funds and other large speculators to the long side of oil. Back then I couldn’t prove what was going on but the inflation adjusted price of oil certainly looked like a bubble.

There wouldn’t be a problem of course if these powerful market participants were taking both or either sides in legitimate speculation or hedging. But there is a problem for everyone, including these same institutions, when they pile into only one side, continuously going long the crude oil futures.

According to the article:

Passive investors increased their crude-oil holdings to the equivalent of more than 600 million barrels in June, up more than 30% from the end of last year…

So what is going on? How can these behemoth institutional players treat the crude oil market like their very own ponzi scheme? Last year the effects on the world economy were devastating. Wealthy economies stalled into a recession and poor economies were thrown into chaos as staple food prices soared.

Isn’t there a regulation to prevent the manipulative “walking up” of prices in commodities? Yes, yes there is. Or more accurately there was.

Matt Taibbi’s scorching article on Goldman Sachs (GS) in the most recent edition of Rolling Stone magazine explains. There was a 1936 government regulation which had successfully stopped this type of shenanigan. In effect it did not allow large speculators to lean on any commodity market and crowd out real producers and consumers. Until 1991. That’s when Goldman Sachs’ (GS) commodities subsidiary, J. Aron, request an exemption based on the flimsiest justification.

Amazingly enough it got it. And over the years the CFTC handed out 14 other similar exemptions. Goldman and its ilk were busy with a few other schemes and it wasn’t for a while that they started to really take advantage of the loophole they had gained. What followed was nothing short of astonishing. For example:

Between 2003 and 2008, the amount of speculative money in commodities grew from $13 billion to $317 billion, an increase of 2,300 percent.

What makes this even more astonishing is that last year’s oil spike (or bubble) happened when the world was awash in oil supply and faced a drastically reduced oil demand!

…according to the US Energy Information Administration,the world oil supply rose from 85.24 million barrels a day to 85.72 million. Over the same period, world oil demand dropped from 86.82 million barrels a day to 86.07 million.

By the summer of 2008, in fact, commodities speculators had bought and stockpiled enough oil futures to fill 1.1 billion barrels of crude, which meant that speculators owned more future oil on paper than there was real, physical oil stored in all of the country’s commercial storage tanks and the Strategic Petroleum Reserve combined.

This whole bear market has been a massive lesson in the validity and value of smart government regulations. As Ritholtz counts off in his book “Bailout Nation”, over a number of years and even decades, the threads of regulation where one by one removed. As the regulatory framework deteriorated in tatters, things started to go wrong.

Of course, as you may recall, that explanation was not the one offered when we were in the thick of things last year. The old and tired theory of “Peak Oil” was on everyone’s lips and many actually believed it.

The problem with that is, in the market when something is obvious to everyone, it is obviously false. And as I’ve said before many times, while no one disputes that the supply of oil is finite, it is a non-sequitur to posit that as this resource is exhausted, the price of oil will spike.

If you believe otherwise, then get into your time machine, go back to the 1800’s and corner the whale blubber market. |