|

- 性别

- 男

- 来自

- 米地乌托邦

|

[闲谈] St. Louis Fed (流氓)经济学家, OIL will BE $0/B BY 2019

本帖最后由 tianfangye 于 2016-2-26 13:21 编辑

你信吗?

https://www.stlouisfed.org/on-the-economy/2016/february/future-oil-price-consistent-inflation-expectations

Results

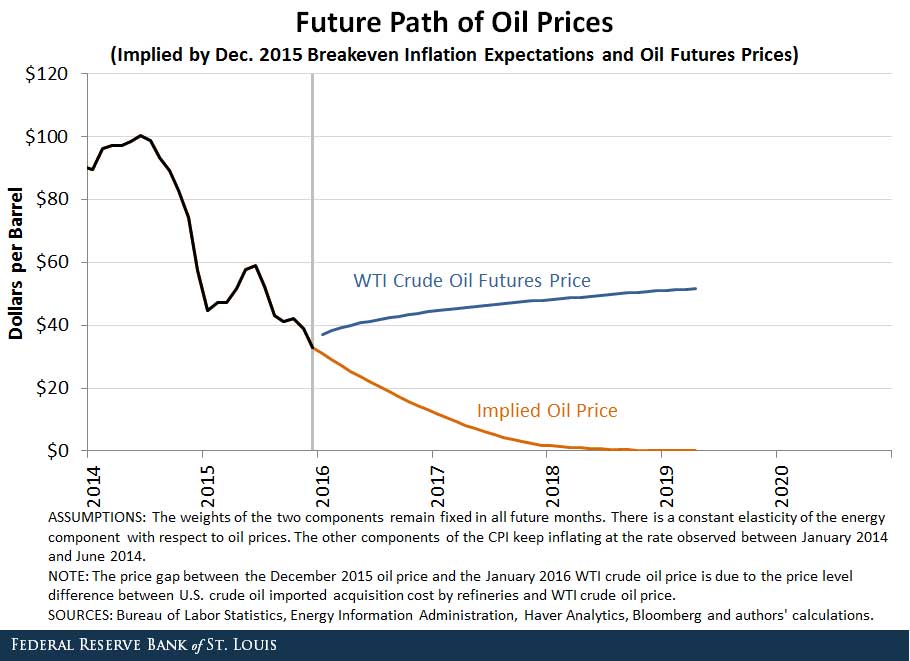

We calculated the future path of the CPI over the next 10 years (starting in January 2016) that would be consistent with breakeven inflation expectations at horizons of one year through 10 years.2 Then, using an annual growth rate of 2.87 percent for the “all items less energy” component and using 0.46 for the elasticity of the energy component with respect to oil prices, we backed out the future path of oil prices that would produce this future path of the CPI.3 The figure below displays the implied oil price series and compares it to the future oil prices implied by West Texas Intermediate crude oil futures. 4

Conclusion

According to our calculations, oil prices would need to fall to $0 per barrel by mid-2019 in order to validate current inflation expectations. After that, there is no oil price that would allow our model to predict a CPI path consistent with December 2015 breakeven inflation expectations. This implied path of oil prices is very different from the path of oil prices implied by futures contracts, which rises to more than $50 per barrel by mid-2019.

We state some potential explanations for our results:- Expectations for the future growth of the other CPI components besides energy may be lower than the annual rate of 2.87 percent we assumed in our model.

- The recent movements in breakeven inflation expectations may have been caused by something other than the decline in oil prices. It is even possible that a third variable is driving the decline in both.

- Investors may expect the relationship between oil price and the CPI energy component to change in the future. (This would be despite the strong relationship seen over the past 20 years, shown in the second figure in our previous blog post.)

- Changes in the inflation risk premium for bonds that are not inflation-protected and/or changes in the liquidity premium for TIPS may be distorting breakeven inflation expectations in the last few months.

Notes and References

1 In this backtest, we performed an out-of-sample prediction of the CPI from July 2014 to December 2015 using the actual path of oil prices over that time period. This is the future CPI path our model would have predicted in June 2014 assuming that we knew what oil prices would be through the end of 2015.

2 We used the December 2015 breakeven inflation expectations to estimate December values of the CPI over the next 10 years from December 2016 to December 2025. We obtained the remaining monthly CPI values by assuming constant growth of the CPI between each of these December estimates.

3 The value of the elasticity of energy component with respect to oil price was estimated via ordinary least squares. See the second figure of our previous blog post.

4 An oil futures contract is a standardized agreement, tradable between parties on an organized exchange, for the seller to deliver a certain quantity of oil to the buyer on a future date at a specific price determined today. The prices of such contracts are often interpreted as the market’s forecasts of spot oil prices. |

-

1

评分人数

-

|