Using Put/Call Open Interest to Predict the Rest of the Week

热12已有 142971 次阅读 2010-08-16 18:36Using Put/Call Open Interest to Predict the Rest of the Week

by admin on August 16, 2010

in Essays/Reports/Articles

Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

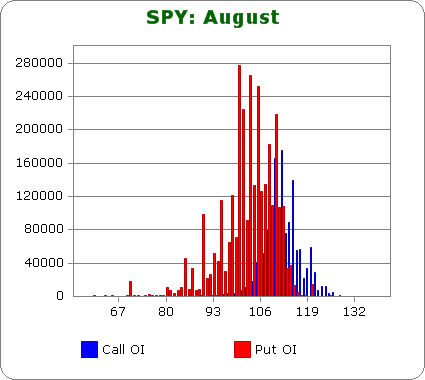

SPY (closed 108.26)

Puts out-number calls more than 2.5-to-1, so bearish sentiment remains high.

Call OI is highest between 108 and 115 with spikes at 110, 112 and 115.

Put OI is highest from 100 to 112.

There’s some overlap in the 108-112 area, but since puts far out-number calls, let’s focus on those to determine where price needs to close Friday to cause the most pain. With SPY closing at 108.26 today, a close right here would expire about 60-70% of the puts worthless, but to really cause a lot of pain, a move to the top of the high-put-open-interest zone near 112 would be better. Hence, a move up the rest of the week is needed.

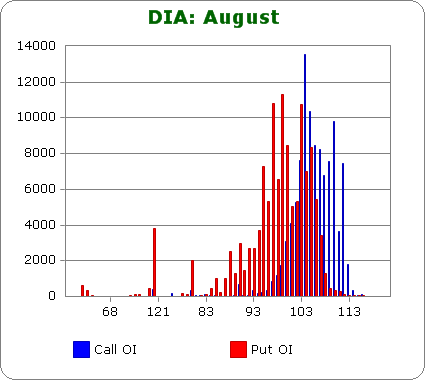

DIA (closed 103.28)

Puts outnumber calls about 1.6 to 1.

Call OI is highest between 103 & 110.

Put OI is highest 97 & 103.

The two zones meet at 103, so it’s easy to say a close there would cause the most pain. DIA closed today at 103.28, so flat trading the rest of the week would accomplish this. But SPY OI is greater than DIA OI by a factor of 24, so it’s best to ignore DIA data unless it has shown to have better predictive capabilities.

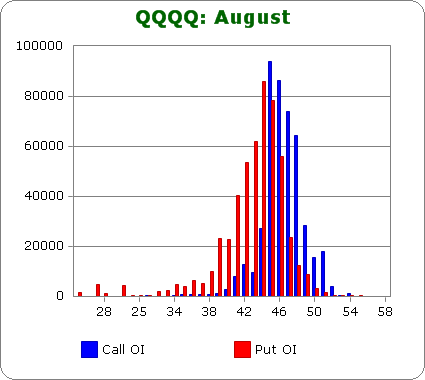

QQQQ (closed 44.80)

Puts out-number calls by 1.5-to-1.

Call OI is highest between 45 & 48.

Put OI is highest between 41 & 46.

There’s overlap between 45 & 46, and with today’s close at 44.80, a little upside movement is needed the next couple days to achieve max pain. But a close right here would cause “enough” pain.

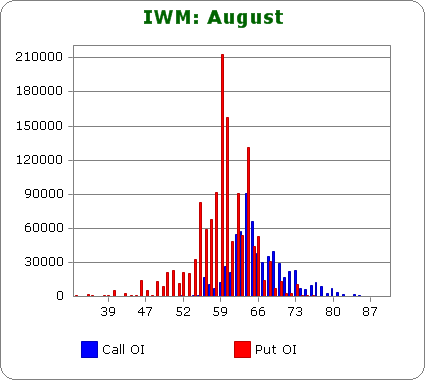

IWM (closed 61.56)

Puts out-number calls by 2.2-to-1.

Call OI is highest 62-69.

Put OI is highest between 55-66.

There’s some between 62 & 66, so similar to SPY, a close right here would cause pain but not an extreme amount of pain. Instead a move up the next couple days is needed to expire more of the puts worthless.

Overall Conclusion: The bears continue to trade in anticipation of a big move down and as of today’s close, they’ll show a net profit. If the market conspires to close such that the most number of options expire worthless to cause the most pain, a bounce is needed the rest of the week.

发表评论 评论 (0 个评论)